Payroll Features

Synchronized Attendance and Payroll

Pulse automatically syncs your attendance data with payroll.

Automatic TDS Deductions

Calculate & deduct TDS whenever you run payroll.

Simple Tax filing

PulseHRM files local level & state level payroll taxes on your behalf

Self Service

Employees are given access to update all their details, regularization of attendance, download pay slips & form 16.

Detailed Reports

PulseHRM’s Prebuilt Standard reports support your payroll reports Let PulseHRM handle year end reports like Form16, TDS.

Time Integration

Import working hours & pay employees easily and accurately

Compliance

Stay compliant with laws through PulseHRM

Employee Access

Allow employees to view payslips & Increments

Expense Mangement

Expense Policy and Approvals, Reimbursements and Loans

Payroll support

Help from payroll experts who care about your team.

Discover how PulseHRM team makes running payroll easier than ever, with smart technology and people who care about you, your business, and your team.

Get in touch with our payroll experts. We’re here to help.

How it works

Run your payroll in minutes.

Payroll shouldn’t take hours. So we made it simple so you can pay your employees on time, every time. With simple guided wizards, your payroll gets processed.

Integrated platform

Everything you need, synced within payroll software

All our features work together seamlessly on one platform — Employee Attendance, Time Tracking, Leave Management, Expense Reimbursement and arrears.

PulseHRM provides MS Excel and CSV downloads that can be imported to other financial software and major banks.

HDFC Bank , ICICI Bank, Axis Bank, Tally, Quickbooks

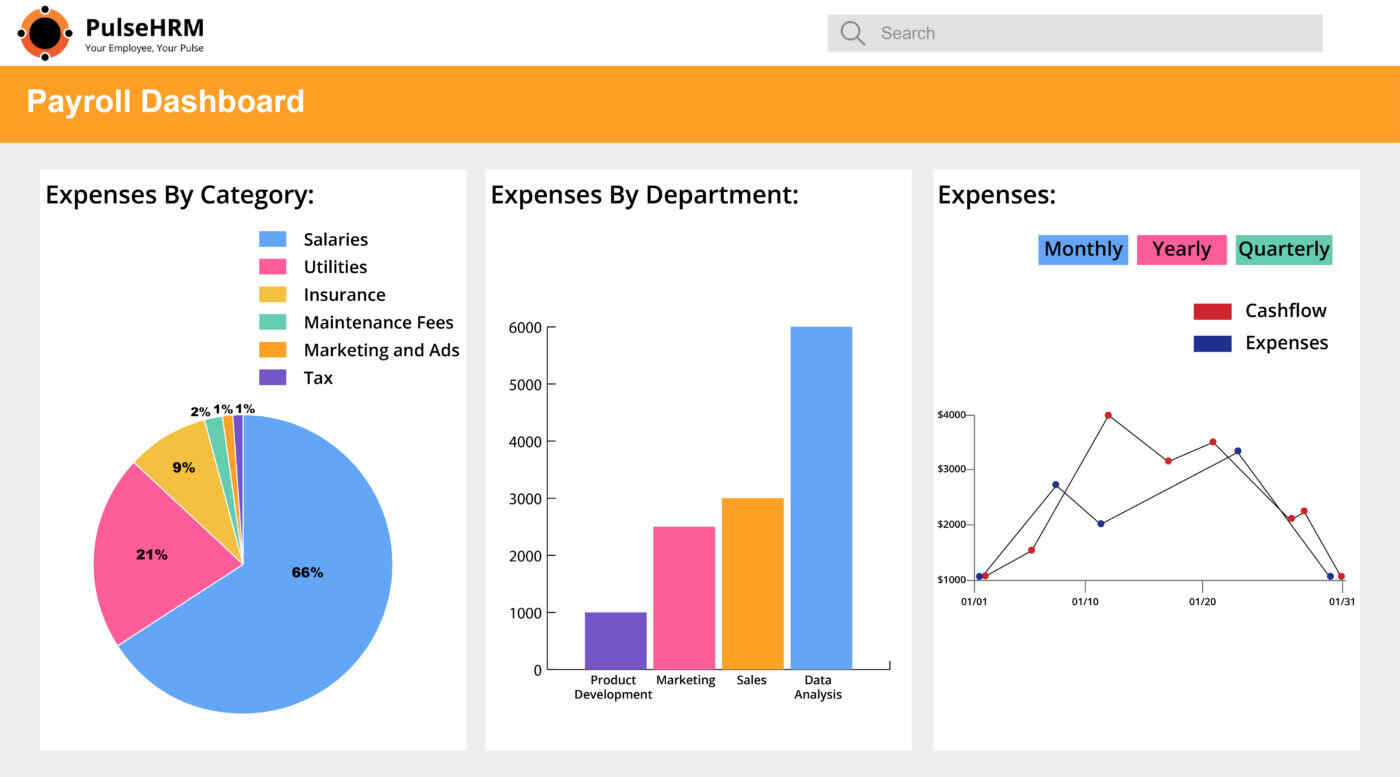

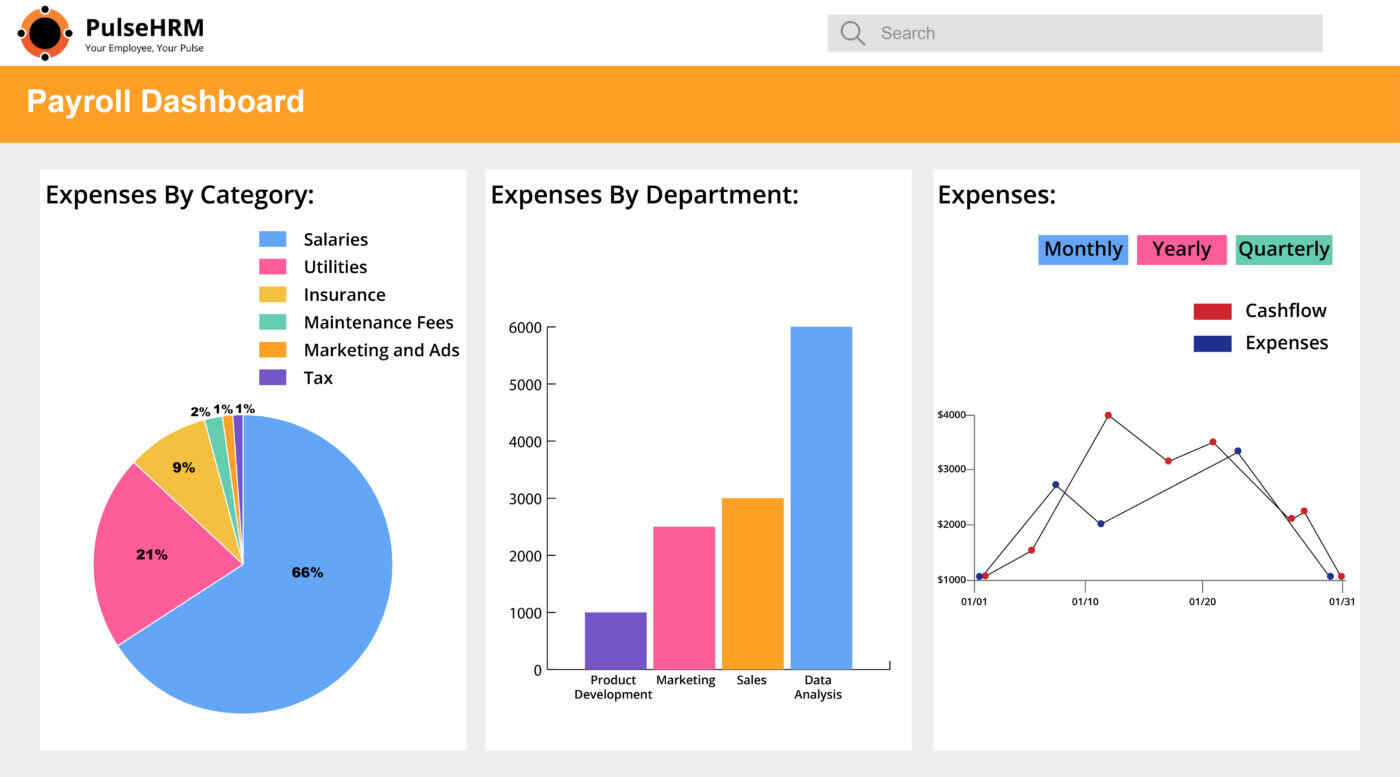

Payroll Analytics

Rich analytics on budgeting and compensation

Track your payroll data, employees and all associated payroll cost elements in one consolidated and consistent reporting model. Analyze and benchmark your data to really understand your workforce cost, drill into local and identify outliers and patterns quickly

Compliance Updates

Adherence to labor and taxation laws

An organizat ion must adhere to the rules and regulations of the state in which the business is established.

Any non-compliance would mean heavy fines, penalties or even complete shutdown in extreme cases.

Well-designed PulseHRM payroll would save money as well as to defame.

Save Time

Empower your employees & Free up valuable time

Track your payroll data, employees and all associated payroll cost elements in one consolidated and consistent reporting model. Analyze and benchmark your data to really understand your workforce cost, drill into local and identify outliers and patterns quickly

Cost Effective

Removing the need to hire a professional

PulseHRM payroll software is cost-effective as you can add all details of employees, generate n-number of payslips, file your statutory returns and many more things in one PulseHRM software.

The software will ensure that the process of salary payment becomes more accurate, efficient, and faster.

Not needing specialized credentials or training, the payroll task can be delegated to employees who have no experience, thus removing the need to hire a professional. This will, in turn, lower your costs and make it possible for cross-training within your small business.

Added Security

Reimbursement remains confidential

Managing with in-house payroll software, the organization is free of sharing inside information about employees and finance of the organization to a third party. The organization would still need to consider the security of its own IT systems, though PulseHRM payroll solution accords with the highest IT security standards.

Self-Service motivates employees.

Access given to your employees

Encouraging employees to use self-service features wherever possible will save time and help your company get the highest return from the investment in the functionality. updating personal details eliminates human errors, encourages employee engagement and saves time. Attendance and its regularisation get synchronized with related modules helping salary processing flawless.

Transition

Smooth transition from your current method

PulseHRM’s payroll module smoothly manages the payment of wages by a company to its employees regardless of their size or workforce.

Even a change in your present biometric to a contemporary Biometric Hardware device, PulseHRM allows the new software to glide smoothly into the system.

Create Payslips

Release Payslips in various formats

Payroll software allows you to quickly and easily generate payslips for all your employees.

Accurate statutory compliances included in payroll ensures that the final amount credited to the employees’ account would be accurate.

PulseHRM payroll software allows you to release payslips in various formats for your employees digitally on their mobile app, email or SMS.

Review Payslips

Preview payroll before releasing

Along with guided wizards you can run preview of the payroll period n number of times and review every aspect of the payroll before finalizing.

The inbuilt interface in PulseHRM payroll software allows you to compare changes from previous pay period and identify changes at micro level.

Syncronized Attendance Payroll, Automatic TDS Deductions and Simple Tax filing

FAQ’S

How complicated is the payroll process?Payroll processing is an essential element of running a business, and doing it alone will be a time-consuming and irritating experience. It’s not only about checking the numbers and keeping detailed records, and you’ll also need to stay updated with new tax rules and deductions.

Payroll becomes more complicated as a company grows, has various locations, and employees share time across multiple cost centers. As a result, the payroll staff spends more time managing information, confirming entries, and correcting errors because mistakes are unavoidable.

Using modern payroll software automates many functions, which ease the payroll processing a bit, but it still is time-consuming and complicated. Following are the reasons why payroll processing is difficult:

Employees in the Wrong Format.

Employee classification errors might have serious consequences. You can recruit freelancers, contractors, and temporary employees based on your business needs, but don’t forget to identify them correctly.

Payroll laws are always changing.

It’s not easy to stay following the law, and there is no quick way to remain on top of payroll regulations. Any changes that occur on a national or local level should be communicated to your payroll staff.

Please encourage them to participate in places where payroll laws are discussed regularly. Before implementing them, it’s best to get new payroll regulations confirmed by experienced officials or outside payroll firms. If you have a payroll management system in place, be sure it keeps up with these developments.

Incorrect Deductions

Calculating the necessary deductions for employees takes a long time. If you make a calculating error, it might cost you a lot of money and result in significant losses. In India, there are various deductions like TDS, EPF, and PT. Hence, it will be hard to manage all deductions with various salary slabs and ranges.

TDS (Tax Deducted at Source)

Tax deductions from earnings also burden the payroll department. You must consider how you will deposit dues like TDS, PF with appropriate authorities and filing.

Payroll is only one aspect of your financial responsibilities, and while it should be a straightforward, regular procedure, it is often quite the opposite. Payroll management is a difficult task, especially when there are many layers of taxation and deductions. As a result, the payroll team must process payroll accurately and quickly. This isn’t generally a problem if you have the correct software or payroll processing services in place.

How do I pick the right payroll software in India?Choosing the best payroll system for your company, regardless of its size, is a critical investment. You will lose time and money if your system is complex and inefficient. Staying updated with varied payroll rules across numerous states is a huge difficulty if you rely on manual techniques. Without a digital payroll system, accuracy and multi-team cooperation suffer as well.

First and foremost, it’s fine if you’re having difficulties with your selection process. Currently, the Indian market is flooded with automated HR solutions. As a result, choose the software having the following features:

- Customizable and intuitive

- Cloud-based

- Reconciliation of data in real-time

- Notifications/alerts that are sent automatically

- Tracking of Attendance and Leave

- Self-service for employees

- Automated payroll reports

- Spreadsheet support

- User roles and permissions

- Automated audit trail reports

- Strong customer support

- Automates the process for TDS, EPF, and PT.

Your company’s payroll software is a critical financial and operational investment. It won’t be easy to transition from an old system to a new one. Consider the size, compensation structure, locations, and recruitment objectives of your organization before deciding.

Always look for payroll software that is customizable and prioritizes user experience, accessibility, support, and security in addition to the key functionality outlined above. Using software that meets these requirements will help you establish a better business that will run smoothly for years.

How does cloud-based payroll software work?Cloud-based services are becoming a requirement for every company. Because of digitization and automation, the company dynamics are continually evolving. As a result, businesses are transforming their employment processes by moving their payroll systems to the cloud.

Any cloud-based HR and payroll tools will help a company’s processes run more smoothly than ever before. Cloud-based payroll software is an excellent way to ensure that your employees have access to all of the information they need regarding their pay.

Your business can use cloud payroll software to automate the process of calculating and submitting payments to your employees under pay condition regulations.

In most cases, cloud payroll systems will allow you to do things like:

- Provident fund payments

- Single Touch Payroll reporting

- automated pay runs under payroll legislation

- distributing payslips to individual employees,

- reports generation for all necessary compliant payroll information

- payroll data record-keeping

- automatically interpreting Modern Award pay conditions

All information is saved in the cloud servers with a cloud-based payroll system so that you can use it at any time and from any location. All you need is a computer with an internet connection, a web browser, and a password. You can view payroll information and authorize payments no matter where you are.

A cloud-based payroll system is a huge assistance for firms operating remotely, including the payroll department. It enables employees to work from home while maintaining access to the same information as in the office. All of this is accomplished while maintaining safe payroll transactions and data management through the use of fine-grained security controls that prevent data breaches and unauthorized access.

Every new update made by your payroll department and government is updated in the system, which you can access using your employee id. It protects data confidentiality and ensures employees that they are getting the right payment.

How to choose the right payroll app for your business?When your payroll system is properly configured, it is a pleasure to use rather than a chore. However, for paid this to happen, your system must adapt to your company’s specific needs and perform the hard lifting for you. Payroll will take minutes rather than hours of your time this way.

So, how do you choose the best payroll software for your company? Here are the criteria you should consider before making your decision.

A. Is this system a good fit for your company?

Your payroll software should adapt to your company’s specific needs. You should never be forced to make judgments solely on the capabilities of your software. Look for these characteristics to make sure your final decision is the best one for you.

Designed for your business

Every piece of payroll software was created with a specific size or type of company in mind. Make sure the one you choose is intuitive and customizable and supports all the requirements of your company.

For example, “If you ask Adidas to print your custom T-Shirt, they will say ‘No’ then we have to go for nearby tailor, but if Lionel Messi asks them to print T-Shirt of his choice, they ask him about how many colors and pieces they have to print”.

It means you have to find the right software that is easy to customize on your own and fits your business requirements.

Serves your geographical area.

Wherever your company works, you’ll require software that complies with local regulations. Make sure your payroll software is tailored to the places you operate, such as your city, state, and the countries in which you do business. You’ll also need compliant software in both India and Nepal if you have staff in both countries.

Additionally, make sure your software is customizable and adapt to your customization.

Simple and Transparent pricing

Make certain there are no hidden costs or contracts. Ideally, you should predict current expenditures based on your present employee count and future costs as your firm grows. If you don’t, you might be surprised to learn that there are a lot of hidden fees once you’ve signed up.

Scalable

Payroll software should grow with your company as it expands. Choose a flexible and adaptable payroll system so you can concentrate on growing your business rather than setting up a new payroll system every few years.

Customer service is really important.

Choose a software vendor who can answer your queries and assist you with your new payroll software setup. Also, make sure there’s a knowledge base available for rapid reference.

B. Is it able to fulfill your requirements?

The best payroll software does the majority of the hard work for you. These are the features it requires to run properly and without stress.

Cloud-based software

Payroll is critical to your business’s success. Using cloud-based software, you will access and update your system from any device, and it is even better if the program has a mobile app. As a result, you and your staff will have easy access to your data anytime you require it.

TDS and EPF is a must.

Provident funds and other deductions are some of the hardest and time-consuming aspects of payroll in a manual system. But, it should be a core feature of your payroll software, and it should handle TDS and EPF, so you don’t have to.

Types of payment

Your payroll software must also handle holiday pay, allowances, cost reimbursements, bonuses, commissions, and other taxable benefits in addition to salary.

Stays updated

As updates are issued, the finest payroll software will automatically download and install them. This is critical for remaining compliant, especially when rate tables change frequently.

Pay structure

You might have some salaried staff, some hourly employees, and others who are a combination. Analyze your payroll software to check if it can handle a variety of compensation plans.

Types of deduction

Medical, dental, life insurance and retirement savings are among the deductions each employee will select. Make sure you specify all of the deductions you offer and then assign them to your employees as applicable.

C. Will it help you save time?

Payroll shouldn’t be a mindless task that takes hours to do. The payroll system will save you time and effort, allowing you to focus on expanding your company. Here are some of the time-saving features to look for.

Simple onboarding and termination of employees

Setting up new employees should be simple. With some clicks on software, you should be able to submit the basic information about their job. This data should ideally sync with the other tools in your payroll stack, so you only have to enter it once.

Because Covid 19 affects the entire world, the onboarding and termination process must be simple and virtual.

Employee self-service

Your software should include a mobile app or an online portal where employees can examine their pay stubs, request time off, and review their time on the job.

Off-cycle payroll

You may need to issue incentives or advances, handle final pay, or make changes on occasion. Before deciding on payroll software, be sure it can manage off-cycle payments as well.

How will payroll software give your business the right edge?Every business person wants their business to flourish. But what factors contribute to a company’s success? Difficulties will inevitably arise, and fighting them with the appropriate tool can help you grow your business.

To be productive, a company must always address obstacles such as employee management, taxation, compliance, etc.

Investing in a system can help you improve your performance and grow your business. However, before investing in a solution, the return on investment (ROI) is critical. An example is an online payroll system.

A payroll system ensures that employees are paid on time and assures employee retention with features such as downloadable reports and a self-service portal. A suitable payroll solution for your industry can give your company the right edge and boost deliverables to some level.

Following are the reasons how payroll software provides the right edge to your business:

It saves time and money.

Payroll calculations conducted by hand take a long time. This is why a good payroll system is created with this problem in mind. Human Resource professionals can save time and work more efficiently as a result of this. The time and money saved by the Payroll system can be put to better use, resulting in the organization’s growth.

Also, it monitors the expenses of your business on a daily, weekly, monthly basis.

Data Availability and Security in the Organization

Payroll systems can access the company database in real-time, and both the administration and the employees can receive information. Employees’ data (wages and leave accounts) and official credentials can be maintained individually. It thus provides crucial information on the company’s growth based on a review of the system database.

Strategic planning

Payroll software is extremely beneficial to an organization’s decision-making and strategic planning processes. It gives accurate information and assists management in making critical decisions and completing tasks. As a result, it directs an organization in the appropriate direction and helps measure its progress through time.

Employee benefits and impact management

According to a study on employee benefits, 11% of businesses offer employee benefits because they deliver a meaningful return on investment (RoI). It improves employee morale and decreases absenteeism. Payroll software offers a useful framework for emphasizing employee benefits and hence aids in analyzing the effect of various schemes on the company’s growth.

Transparency at all levels of an organization

The payroll system aids in the proper channeling of data and provides access to authorized personnel. Payroll systems have access to data and so play a vital part in determining the organization’s growth.

Time and attendance tracking

The Payroll system maintains a real-time record of the employees’ entry and exit times, allowing you to keep track of them. The geography of the expansion over the years is depicted by detailed records of employee input time mixed with productive output.

Errors elimination

Payroll errors can cost you a lot of money, and as a result, manual payroll is no longer used. The Payroll system is a significant asset that may help you have everything under one roof because it can provide you with vital information on how the company is doing.

Payroll Features

Synchronized Attendance and Payroll

Pulse automatically syncs your attendance data with payroll.

Automatic TDS Deductions

Calculate & deduct TDS whenever you run payroll.

Simple Tax filing

PulseHRM files local level & state level payroll taxes on your behalf

Self Service

Employees are given access to update all their details, regularization of attendance, download pay slips & form 16.

Detailed Reports

PulseHRM’s Prebuilt Standard reports support your payroll reports Let PulseHRM handle year end reports like Form16, TDS.

Time Integration

Import working hours & pay employees easily and accurately

Compliance

Stay compliant with laws through PulseHRM

Employee Access

Allow employees to view payslips & Increments

Expense Mangement

Expense Policy and Approvals, Reimbursements and Loans

Payroll support

Help from payroll experts who care about your team.

Discover how PulseHRM team makes running payroll easier than ever, with smart technology and people who care about you, your business, and your team.

Get in touch with our payroll experts. We’re here to help.

How it works

Run your payroll in minutes.

Payroll shouldn’t take hours. So we made it simple so you can pay your employees on time, every time. With simple guided wizards, your payroll gets processed.

Integrated platform

Everything you need, synced within payroll software

All our features work together seamlessly on one platform — Employee Attendance, Time Tracking, Leave Management, Expense Reimbursement and arrears.

PulseHRM provides MS Excel and CSV downloads that can be imported to other financial software and major banks.

HDFC Bank , ICICI Bank, Axis Bank, Tally, Quickbooks

Payroll Analytics

Rich analytics on budgeting and compensation

Track your payroll data, employees and all associated payroll cost elements in one consolidated and consistent reporting model. Analyze and benchmark your data to really understand your workforce cost, drill into local and identify outliers and patterns quickly

Compliance Updates

Adherence to labor and taxation laws

An organizat ion must adhere to the rules and regulations of the state in which the business is established.

Any non-compliance would mean heavy fines, penalties or even complete shutdown in extreme cases.

Well-designed PulseHRM payroll would save money as well as to defame.

Save Time

Empower your employees & Free up valuable time

Track your payroll data, employees and all associated payroll cost elements in one consolidated and consistent reporting model. Analyze and benchmark your data to really understand your workforce cost, drill into local and identify outliers and patterns quickly

Cost Effective

Removing the need to hire a professional

PulseHRM payroll software is cost-effective as you can add all details of employees, generate n-number of payslips, file your statutory returns and many more things in one PulseHRM software.

The software will ensure that the process of salary payment becomes more accurate, efficient, and faster.

Not needing specialized credentials or training, the payroll task can be delegated to employees who have no experience, thus removing the need to hire a professional. This will, in turn, lower your costs and make it possible for cross-training within your small business.

Added Security

Reimbursement remains confidential

Managing with in-house payroll software, the organization is free of sharing inside information about employees and finance of the organization to a third party. The organization would still need to consider the security of its own IT systems, though PulseHRM payroll solution accords with the highest IT security standards.

Self-Service motivates employees.

Access given to your employees

Encouraging employees to use self-service features wherever possible will save time and help your company get the highest return from the investment in the functionality. updating personal details eliminates human errors, encourages employee engagement and saves time. Attendance and its regularisation get synchronized with related modules helping salary processing flawless.

Transition

Smooth transition from your current method

PulseHRM’s payroll module smoothly manages the payment of wages by a company to its employees regardless of their size or workforce.

Even a change in your present biometric to a contemporary Biometric Hardware device, PulseHRM allows the new software to glide smoothly into the system.

Create Payslips

Release Payslips in various formats

Payroll software allows you to quickly and easily generate payslips for all your employees.

Accurate statutory compliances included in payroll ensures that the final amount credited to the employees’ account would be accurate.

PulseHRM payroll software allows you to release payslips in various formats for your employees digitally on their mobile app, email or SMS.

Review Payslips

Preview payroll before releasing

Along with guided wizards you can run preview of the payroll period n number of times and review every aspect of the payroll before finalizing.

The inbuilt interface in PulseHRM payroll software allows you to compare changes from previous pay period and identify changes at micro level.

FAQ’S

Payroll processing is an essential element of running a business, and doing it alone will be a time-consuming and irritating experience. It’s not only about checking the numbers and keeping detailed records, and you’ll also need to stay updated with new tax rules and deductions.

Payroll becomes more complicated as a company grows, has various locations, and employees share time across multiple cost centers. As a result, the payroll staff spends more time managing information, confirming entries, and correcting errors because mistakes are unavoidable.

Using modern payroll software automates many functions, which ease the payroll processing a bit, but it still is time-consuming and complicated. Following are the reasons why payroll processing is difficult:

Employees in the Wrong Format.

Employee classification errors might have serious consequences. You can recruit freelancers, contractors, and temporary employees based on your business needs, but don’t forget to identify them correctly.

Payroll laws are always changing.

It’s not easy to stay following the law, and there is no quick way to remain on top of payroll regulations. Any changes that occur on a national or local level should be communicated to your payroll staff.

Please encourage them to participate in places where payroll laws are discussed regularly. Before implementing them, it’s best to get new payroll regulations confirmed by experienced officials or outside payroll firms. If you have a payroll management system in place, be sure it keeps up with these developments.

Incorrect Deductions

Calculating the necessary deductions for employees takes a long time. If you make a calculating error, it might cost you a lot of money and result in significant losses. In India, there are various deductions like TDS, EPF, and PT. Hence, it will be hard to manage all deductions with various salary slabs and ranges.

TDS (Tax Deducted at Source)

Tax deductions from earnings also burden the payroll department. You must consider how you will deposit dues like TDS, PF with appropriate authorities and filing.

Payroll is only one aspect of your financial responsibilities, and while it should be a straightforward, regular procedure, it is often quite the opposite. Payroll management is a difficult task, especially when there are many layers of taxation and deductions. As a result, the payroll team must process payroll accurately and quickly. This isn’t generally a problem if you have the correct software or payroll processing services in place.

Choosing the best payroll system for your company, regardless of its size, is a critical investment. You will lose time and money if your system is complex and inefficient. Staying updated with varied payroll rules across numerous states is a huge difficulty if you rely on manual techniques. Without a digital payroll system, accuracy and multi-team cooperation suffer as well.

First and foremost, it’s fine if you’re having difficulties with your selection process. Currently, the Indian market is flooded with automated HR solutions. As a result, choose the software having the following features:

- Customizable and intuitive

- Cloud-based

- Reconciliation of data in real-time

- Notifications/alerts that are sent automatically

- Tracking of Attendance and Leave

- Self-service for employees

- Automated payroll reports

- Spreadsheet support

- User roles and permissions

- Automated audit trail reports

- Strong customer support

- Automates the process for TDS, EPF, and PT.

Your company’s payroll software is a critical financial and operational investment. It won’t be easy to transition from an old system to a new one. Consider the size, compensation structure, locations, and recruitment objectives of your organization before deciding.

Always look for payroll software that is customizable and prioritizes user experience, accessibility, support, and security in addition to the key functionality outlined above. Using software that meets these requirements will help you establish a better business that will run smoothly for years.

Cloud-based services are becoming a requirement for every company. Because of digitization and automation, the company dynamics are continually evolving. As a result, businesses are transforming their employment processes by moving their payroll systems to the cloud.

Any cloud-based HR and payroll tools will help a company’s processes run more smoothly than ever before. Cloud-based payroll software is an excellent way to ensure that your employees have access to all of the information they need regarding their pay.

Your business can use cloud payroll software to automate the process of calculating and submitting payments to your employees under pay condition regulations.

In most cases, cloud payroll systems will allow you to do things like:

- Provident fund payments

- Single Touch Payroll reporting

- automated pay runs under payroll legislation

- distributing payslips to individual employees,

- reports generation for all necessary compliant payroll information

- payroll data record-keeping

- automatically interpreting Modern Award pay conditions

All information is saved in the cloud servers with a cloud-based payroll system so that you can use it at any time and from any location. All you need is a computer with an internet connection, a web browser, and a password. You can view payroll information and authorize payments no matter where you are.

A cloud-based payroll system is a huge assistance for firms operating remotely, including the payroll department. It enables employees to work from home while maintaining access to the same information as in the office. All of this is accomplished while maintaining safe payroll transactions and data management through the use of fine-grained security controls that prevent data breaches and unauthorized access.

Every new update made by your payroll department and government is updated in the system, which you can access using your employee id. It protects data confidentiality and ensures employees that they are getting the right payment.

When your payroll system is properly configured, it is a pleasure to use rather than a chore. However, for paid this to happen, your system must adapt to your company’s specific needs and perform the hard lifting for you. Payroll will take minutes rather than hours of your time this way.

So, how do you choose the best payroll software for your company? Here are the criteria you should consider before making your decision.

A. Is this system a good fit for your company?

Your payroll software should adapt to your company’s specific needs. You should never be forced to make judgments solely on the capabilities of your software. Look for these characteristics to make sure your final decision is the best one for you.

Designed for your business

Every piece of payroll software was created with a specific size or type of company in mind. Make sure the one you choose is intuitive and customizable and supports all the requirements of your company.

For example, “If you ask Adidas to print your custom T-Shirt, they will say ‘No’ then we have to go for nearby tailor, but if Lionel Messi asks them to print T-Shirt of his choice, they ask him about how many colors and pieces they have to print”.

It means you have to find the right software that is easy to customize on your own and fits your business requirements.

Serves your geographical area.

Wherever your company works, you’ll require software that complies with local regulations. Make sure your payroll software is tailored to the places you operate, such as your city, state, and the countries in which you do business. You’ll also need compliant software in both India and Nepal if you have staff in both countries.

Additionally, make sure your software is customizable and adapt to your customization.

Simple and Transparent pricing

Make certain there are no hidden costs or contracts. Ideally, you should predict current expenditures based on your present employee count and future costs as your firm grows. If you don’t, you might be surprised to learn that there are a lot of hidden fees once you’ve signed up.

Scalable

Payroll software should grow with your company as it expands. Choose a flexible and adaptable payroll system so you can concentrate on growing your business rather than setting up a new payroll system every few years.

Customer service is really important.

Choose a software vendor who can answer your queries and assist you with your new payroll software setup. Also, make sure there’s a knowledge base available for rapid reference.

B. Is it able to fulfill your requirements?

The best payroll software does the majority of the hard work for you. These are the features it requires to run properly and without stress.

Cloud-based software

Payroll is critical to your business’s success. Using cloud-based software, you will access and update your system from any device, and it is even better if the program has a mobile app. As a result, you and your staff will have easy access to your data anytime you require it.

TDS and EPF is a must.

Provident funds and other deductions are some of the hardest and time-consuming aspects of payroll in a manual system. But, it should be a core feature of your payroll software, and it should handle TDS and EPF, so you don’t have to.

Types of payment

Your payroll software must also handle holiday pay, allowances, cost reimbursements, bonuses, commissions, and other taxable benefits in addition to salary.

Stays updated

As updates are issued, the finest payroll software will automatically download and install them. This is critical for remaining compliant, especially when rate tables change frequently.

Pay structure

You might have some salaried staff, some hourly employees, and others who are a combination. Analyze your payroll software to check if it can handle a variety of compensation plans.

Types of deduction

Medical, dental, life insurance and retirement savings are among the deductions each employee will select. Make sure you specify all of the deductions you offer and then assign them to your employees as applicable.

C. Will it help you save time?

Payroll shouldn’t be a mindless task that takes hours to do. The payroll system will save you time and effort, allowing you to focus on expanding your company. Here are some of the time-saving features to look for.

Simple onboarding and termination of employees

Setting up new employees should be simple. With some clicks on software, you should be able to submit the basic information about their job. This data should ideally sync with the other tools in your payroll stack, so you only have to enter it once.

Because Covid 19 affects the entire world, the onboarding and termination process must be simple and virtual.

Employee self-service

Your software should include a mobile app or an online portal where employees can examine their pay stubs, request time off, and review their time on the job.

Off-cycle payroll

You may need to issue incentives or advances, handle final pay, or make changes on occasion. Before deciding on payroll software, be sure it can manage off-cycle payments as well.

Every business person wants their business to flourish. But what factors contribute to a company’s success? Difficulties will inevitably arise, and fighting them with the appropriate tool can help you grow your business.

To be productive, a company must always address obstacles such as employee management, taxation, compliance, etc.

Investing in a system can help you improve your performance and grow your business. However, before investing in a solution, the return on investment (ROI) is critical. An example is an online payroll system.

A payroll system ensures that employees are paid on time and assures employee retention with features such as downloadable reports and a self-service portal. A suitable payroll solution for your industry can give your company the right edge and boost deliverables to some level.

Following are the reasons how payroll software provides the right edge to your business:

It saves time and money.

Payroll calculations conducted by hand take a long time. This is why a good payroll system is created with this problem in mind. Human Resource professionals can save time and work more efficiently as a result of this. The time and money saved by the Payroll system can be put to better use, resulting in the organization’s growth.

Also, it monitors the expenses of your business on a daily, weekly, monthly basis.

Data Availability and Security in the Organization

Payroll systems can access the company database in real-time, and both the administration and the employees can receive information. Employees’ data (wages and leave accounts) and official credentials can be maintained individually. It thus provides crucial information on the company’s growth based on a review of the system database.

Strategic planning

Payroll software is extremely beneficial to an organization’s decision-making and strategic planning processes. It gives accurate information and assists management in making critical decisions and completing tasks. As a result, it directs an organization in the appropriate direction and helps measure its progress through time.

Employee benefits and impact management

According to a study on employee benefits, 11% of businesses offer employee benefits because they deliver a meaningful return on investment (RoI). It improves employee morale and decreases absenteeism. Payroll software offers a useful framework for emphasizing employee benefits and hence aids in analyzing the effect of various schemes on the company’s growth.

Transparency at all levels of an organization

The payroll system aids in the proper channeling of data and provides access to authorized personnel. Payroll systems have access to data and so play a vital part in determining the organization’s growth.

Time and attendance tracking

The Payroll system maintains a real-time record of the employees’ entry and exit times, allowing you to keep track of them. The geography of the expansion over the years is depicted by detailed records of employee input time mixed with productive output.

Errors elimination

Payroll errors can cost you a lot of money, and as a result, manual payroll is no longer used. The Payroll system is a significant asset that may help you have everything under one roof because it can provide you with vital information on how the company is doing.